|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Subprime Home Equity Loans: Navigating Options and ConcernsWhat Are Subprime Home Equity Loans?Subprime home equity loans are financial products offered to borrowers with less-than-perfect credit scores. These loans allow homeowners to borrow against the equity of their home, often at higher interest rates due to increased risk for lenders. Key Features of Subprime Home Equity LoansHigher Interest RatesOne of the most significant characteristics of subprime loans is the higher interest rates. Lenders charge more to offset the risk associated with borrowers who have poor credit histories. Loan Terms and ConditionsThese loans can come with varying terms, often between 5 to 30 years. It is crucial for borrowers to understand the specific conditions attached to their loan agreements. Impact on Credit ScoreSuccessfully managing a subprime home equity loan can potentially improve a borrower's credit score over time. However, missed payments can further damage credit. Pros and Cons

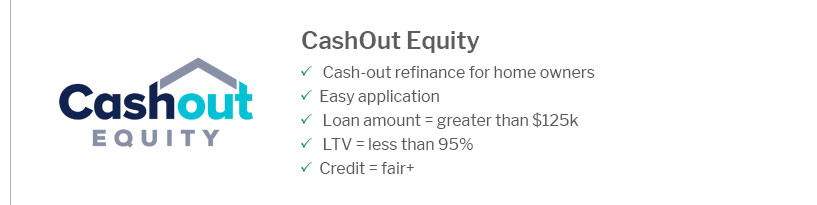

Alternatives to Subprime Home Equity LoansFor those considering alternatives, exploring other options like a new york refinance or looking for the best heloc rates tn might offer more favorable terms. Frequently Asked QuestionsWhat is a subprime home equity loan?A subprime home equity loan is a type of loan available to individuals with poor credit scores, allowing them to borrow against their home equity at higher interest rates. How does a subprime loan affect my credit score?Properly managing the loan by making timely payments can improve your credit score, while missed payments can negatively impact it further. Are there alternatives to subprime home equity loans?Yes, alternatives such as refinancing options or home equity lines of credit with better terms may be available, depending on your financial situation. https://www.bankrate.com/home-equity/home-equity-loan-bad-credit/

Some home equity lenders allow for FICO scores in the fair range (the lower 600s) as long as you meet other requirements around debt, equity and income. https://point.com/blog/guaranteed-home-equity-loan-with-bad-credit

Subprime loans: Subprime lenders specialize in lending to borrowers with bad credit. These loans tend to have higher rates and fees, but you can ... https://www.dfs.ny.gov/consumers/help_for_homeowners/interest_rates

one whose total points and fees exceed six percent of the total loan amount if the total loan amount is fifty thousand dollars or more and the loan is a ...

|

|---|